by dev | Sep 1, 2019 | Articles, Newsletter Vol 4 No 15

Jitendra Rathod, newsletter contributing editor, provides insights into how blockchain technology is changing the world. The nineteenth-century saw the discovery of electricity and soon enough it was put to use in practically all fields of life: from light bulbs...

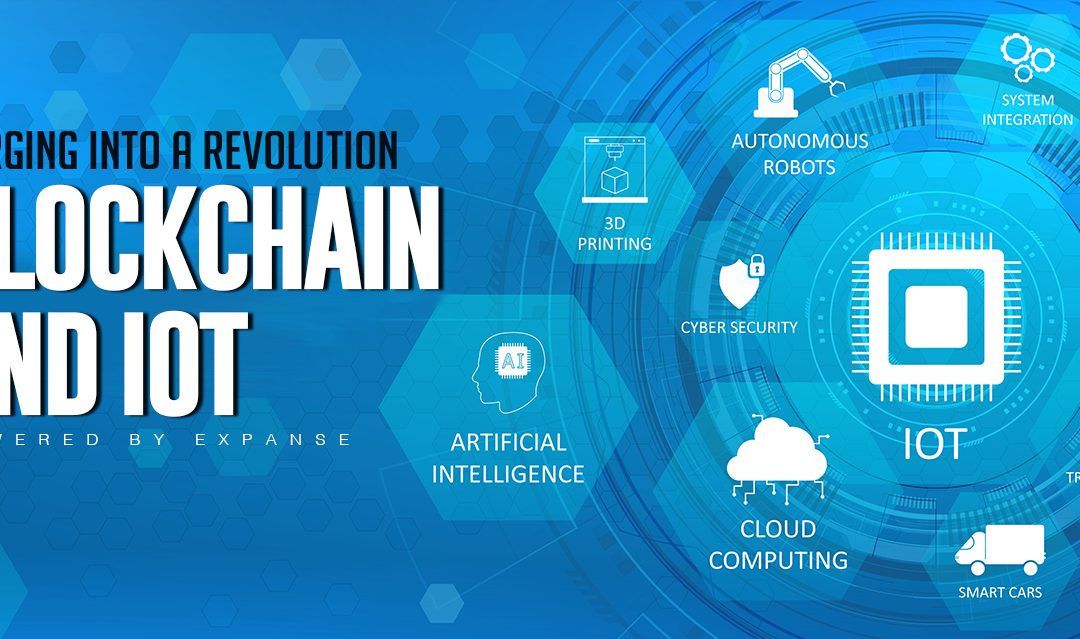

by dev | Aug 2, 2019 | Articles, Newsletter Vol 4 No 13

Jitendra Rathod, newsletter contributing editor, provides insights into the ongoing technological revolution that is underway via the Internet. Ever since humans have occupied the earth, centuries have been marked by inventions and innovations which have brought...

by dev | Jul 2, 2019 | Articles, Newsletter Vol 4 No 11

Jitendra Rathod, newsletter contributing editor, weighs in on the daunting impact Blockchain technology is positioning to have on the new world order. Every century has witnessed the development of a new technology which has changed the face of the world— from...

by dev | May 2, 2019 | Newsletter Vol 4 No 8

Here’s an article submitted by Jitendra Rathod, newsletter contributing editor. Cryptocurrency transactions on the blockchain are similar to an intricately woven web. Since millions of transactions occur regularly around the world, the blockchain becomes a jumbled-up...

by dev | Apr 2, 2019 | Articles, Newsletter Vol 4 No 6

Here’s an article submitted by Jitendra Rathod, newsletter contributing editor, that takes the discussion from the last article forward. The previous article concluded with the suggestion that Big Data can help banks stay relevant in these times. Lets see how. It’s...