Welcome to Expanse

A Community Driven, Censorship Resistant, DAG-Free Proof of Work, EVM Blockchain

Expanse is the longest enduring Proof of Work smart contract blockchain and the world’s first blockchain to implement FRKHASH. We are a community with a shared interested in creating a vibrant borderless and permissionless ecosystem that benefits all of those who use it. If you are interested in contributing, just say the word!

Welcome to Expanse

Let’s create the world we want to live in

Expanse has been around since 2015!

Explore some useful links:

Our Blockchain Tech

Expanse is an open blockchain platform forked from Ethereum that lets anyone build and use decentralized applications that run on blockchain technology.

Roadmap 2024

- Expanse treasury

- Stake holder incentives

- Incentives fullnodes

- Crosschain Transactions

- More CEX Listings

- Bridge

Get Expanse

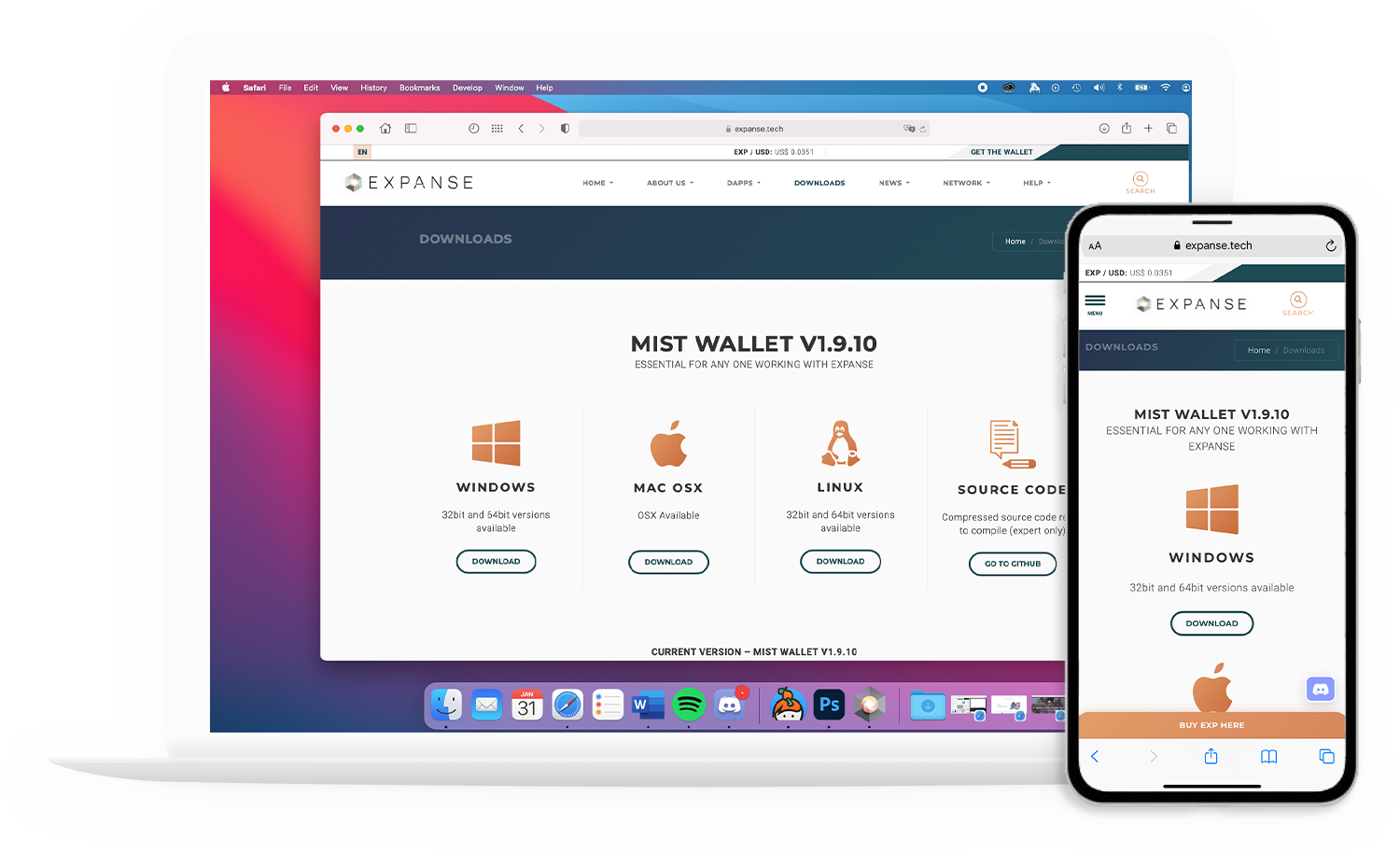

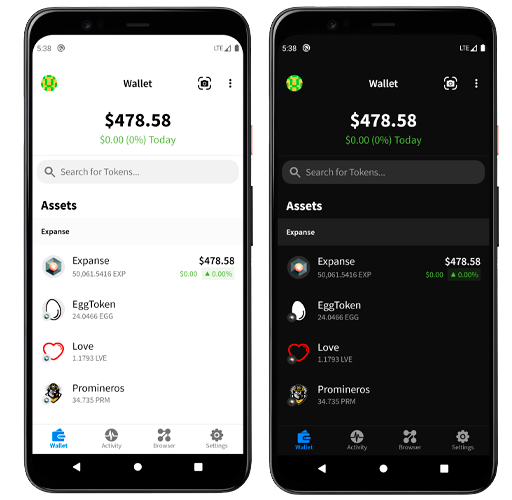

Download Exp Wallet

This is essential for any one working with Expanse, download the mist wallet V1,9,10. Also get a list of third party wallets you can use.

Download our mobile Expanse wallet

Why choose Expanse?

Launched in 2015

Worlds First Blockchain To use FRKHash.

No memory requirement for mining

Decentralized and open source

Extensive industry partnerships

Dedicated team of forward-thinking devs

Expanse market data

Markets

Last 24h VOL

US$ 23.08

MarketCap

US$ 58,258.77

2024-04-26T02:03:00.000Z

Circulating (EXP)

53,211,968.77

Total 53,211,968.77 EXP

Price

US$ 0.00109484

-10.03%

our founder

Christopher Franko

CEO, Expanse / Chief Developer

Trained as a full-stack software engineer, Christopher has developed a wide range of innovative projects, from web and mobile apps to decentralized autonomous organizations and everything in between, including Expanse. Christopher was one of blockchain’s earliest adopters and possesses a deep understanding and expert-level knowledge of the industry. He’s also a passionate believer in decentralization, lifelong learning and individual empowerment.

Path to $100

The New Mining Algorithm

by Chris Franko

FRKHASH makes mining EXP, more energy efficient, cost effective and accessible to the largest body of computational devices. By optimizing the memory requirements away, we have increased the longevity and viability of your mining rigs.

Our Partners

Latest partnerships

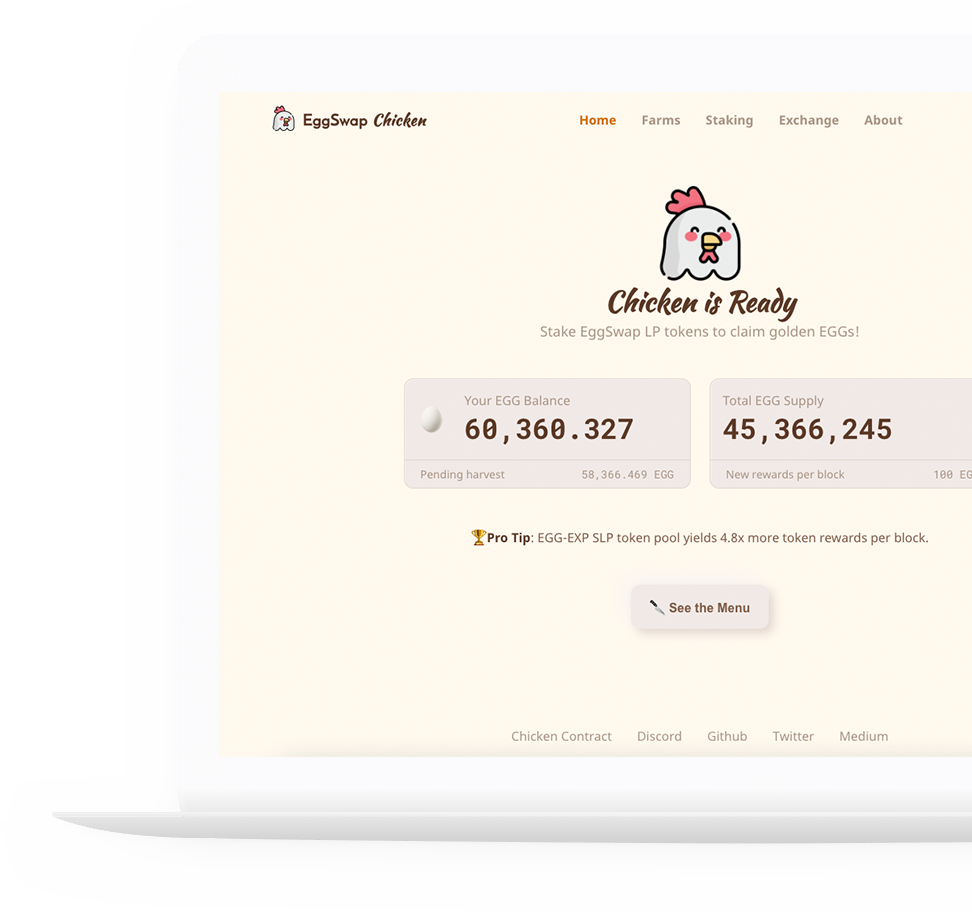

EGGSWAP

Our Decentralized Exchange

EggSwap is an automated market making (AMM) decentralized exchange (DEX) currently on the Expanse blockchain. This is a project run by the community and with the support of the Expanse Team.

Check our Newsletters

monthly publication

EXPANSE NEWSLETTER VOL. 6, NO. 4 – 10/31/2021

Welcome to the 5th Expanse Newsletter of 2021. We are in a new moment for Expanse. After 7 years in the blockchain world we have learned a lot about our community and its needs, today we are growing in Latin America along with this new great trend. Today we have a great participation in this market.

EXPANSE NEWSLETTER VOL. 6, NO. 4 – 08/15/2021

Welcome to the 4th Expanse Newsletter of 2021 a lot of things have happened in Expanse. The new mining Algo is on the way and we are working closely with the recent Central America movement and have already launched 2 tokens for 2 countries on our platform.

EXPANSE NEWSLETTER VOL. 6, NO. 3 – 05/31/2021

Welcome to the 3rd Expanse Newsletter of 2021 a lot of things have happened in Expanse. The token projects are growing fast and communities around EggsSwap, we had a Live with the growing Spanish Community, and much more. Well we invite you to read this impressive Newsletter and we hope to continue publishing it once a month.